|

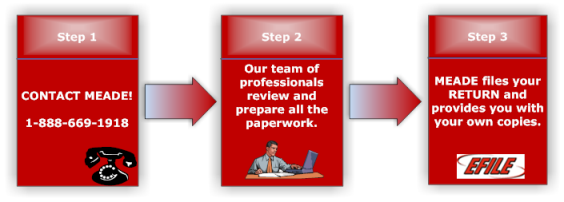

ResourcesOur process in preparing your individual, small business or corporation tax returns is extremely simple and effective from a time management principal. First, you contact us. Second, we discuss your individual circumstances, you send Meade the information we request. Third, with your approval, Meade prepares your returns and files them. Easy as 1 – 2 – 3.

We proudly service our new and existing clients across all parts of Canada including: Toronto (GTA), Brampton, Vaughan, Mississauga, Richmond Hill, Markham, Thornhill, Oshawa, Pickering, Ajax, Oakville, Woodbridge, Concord, Maple, Milton, Whitby, Hamilton, Ottawa, Vancouver, Calgary, Edmonton, Winnipeg, Halifax and more...

Featured Articles

Company and Director each fined $250,000

Ian George McIntyre, age 65, of Spruce Grove, and Global Enviro Inc., of Calgary, were found guilty in Calgary Provincial Court of attempting to falsely obtain a Scientific Research and Experimental Development (SR&ED) credit. As a result, they were each fined $250,000 for a total fine of $500,000..

|  |

Victoria area builder sentenced for tax evasion

Victoria, British Columbia, November 4, 2009... Ian D. McArthur, of Nanaimo, pleaded guilty on October 28, 2009 to one count of income tax evasion and one count of goods and services tax (GST) evasion..

|  |

Local businessman fined $63,200

Winnipeg, Manitoba, November 12, 2009…The Canada Revenue Agency (CRA) announced today that Mr. Yeoun-Kyu Jang, a Winnipeg retailer, was recently fined a total of $63,200.

|  |

tax preparer fined $275,186

Edmundston, New Brunswick, November 13, 2009... Daniel Paradis, a local tax preparer, was fined $275,196 and sentenced to a conditional term of two years less a day of house arrest after being convicted of multiple counts of tax evasion,.

|  |

Labrador man fined for failure to file tax returns

Happy Valley-Goose Bay, Newfoundland and Labrador, October 29, 2009 ... Makkes Penashue of North West River, Labrador, pleaded guilty October 27 in Happy Valley-Goose Bay Provincial Court to two counts of failing to file his personal income tax returns.

|  |

Business Structure

There are several business structures:

• Sole proprietorship

• Partnership

• Corporation

• Registered charity

• Non-profit organizations

• Trusts.

|  |

Recent Articles

Business Structure

There are several business structures:

• Sole proprietorship

• Partnership

• Corporation

• Registered charity

• Non-profit organizations

• Trusts.

|  |

2011 Income Tax Rates

These are the rates that an individual will use when completing their 2011 income tax and benefit return. The information may change during the year to reflect updates to the law...

|  |

Appeals and objections for GST/HST

A taxpayer who disagrees with CRA's ( Canada Revenue Agency ) assessment of a particular return may appeal the assessment. CRA provides for a formal objection process for taxpayers. The process commences with the filing of a Notice of Objection to an assessment or a reassessment.

|  |

|

|